This article was first posted on Kitfoxgames.com as part of an analysis of Moon Hunters, our most recently released game.

I gathered data from 18 different indie games (with their permission, and I even got permission to show you the aggregated data afterwards), and compared their sales in Russia and Eastern Europe along several axes.

The data set included games from various genres, with varying levels of financial success, and generally no marketing efforts spent on the region.

The data isn’t extensive enough to look for statistical significance, but there are a few interesting trends.

Major Takeaways:

Localizing to Russian could double your revenue in Russia, but has no effect in the rest of Eastern Europe

Early Access seems more popular in Russia (maybe due to lower prices?)

Mobile games crossing over into Steam seem to do better in Russia (and overall?)

There is no clear genre pattern to the region

Anecdotally, targeting Russia with marketing doubled their Russian revenues proportional to other regions.

$9.99 games sell marginally better in eastern markets than $14.99 games, but are also generally less successful.

Accidental findings:

Early Access games are generally rated 5 points higher in Steam User Reviews than non-Early Access games? Hmm. I guess that fan-listening-thing really works.

The $14.99 games were also generally rated 5 points higher in Steam User Reviews than $9.99 games.

Disclaimers:

All data is self-reported. It’s possible they are all liars… and/or that indies who would take the time to self-report to a survey on Eastern Europe are particular (more business-oriented? more inexperienced? more trusting? more data-driven?), or make a particular kind of game. With only 18 games, it’s easy for there to be a skew.

“% Rev” means overall, how much total revenue from the game so far was from Russia or Eastern Europe (EE)… not how many units sold. Proportional dollars. Err, rubles.

The “success” measure in particular is very subjective, only measuring how the survey participant felt the game covered their development costs.

16 of the 18 devs were based in North America, 2 in Western Europe. It’s possible this data mostly just shows what it’s like for American & Canadian developers, with no relevance to the rest of the world.

If a given category (for example, games with released console ports) has 3 or fewer entries, I have faded out that bar. Faded bars should be considered anecdotal at best, misleading at worst.

All right, let’s actually look at the data.

What's the Landscape?

Generally, you should expect ~3% of your sales to come from Russia, and less than 2% to come from Eastern Europe. However, there’s the potential for a lot more.

% Rev vs % Units: In general, everyone's percentage of units sold in both regions was much higher than the percentage of revenue from the region, especially in Eastern Europe. This means that the copies were purchased at a relatively high discount compared to other regions. Only 3 of the 18 games had % Rev higher than % Units in Russia (and 0 saw this in Eastern Europe).

“Success”: Note the scale of that final category isn’t quite the same as the others — “Success” (again, self-reported, and simply “how well did/will this game make back its money”) had a minimum of 1 and maximum of 5, while the others are a percentage, therefore a minimum 0 and theoretical maximum of 100. But in general, it looks like the respondents in this group made back their money (average of ~3.4).. that alone indicates we probably do have a skew. Anyway, moving ahead.

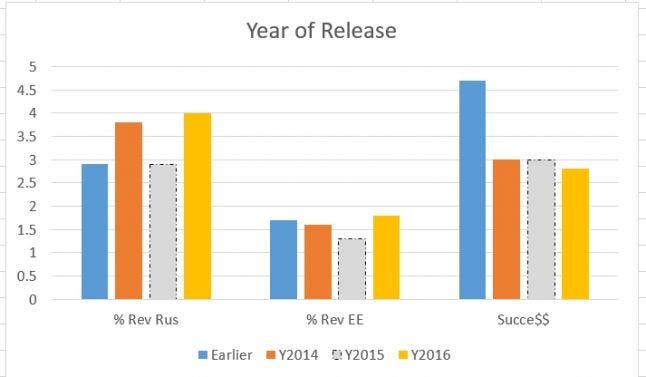

What Year Did Your Game Release?

I wondered if Russia was growing or shrinking over time. There doesn’t seem to be a huge difference, except that maybe Russia has become more interested in Steam since 2014… but if so, the rest of Eastern Europe hasn’t followed.

One game was excluded, because it was still in Early Access.

It’s also interesting how high 2016 is, given that we’re only halfway through. That implies that the first half of 2016 has resulted in the same percentage of revenue (and same estimated success) as games that were already out for all of 2015. Proponents of the indiepocalypse theory will point how how high “pre-2014” success was, but I would counter that it’s possible this just reflects the long tail, or that whatever explosion we feared happened 2+ years ago.

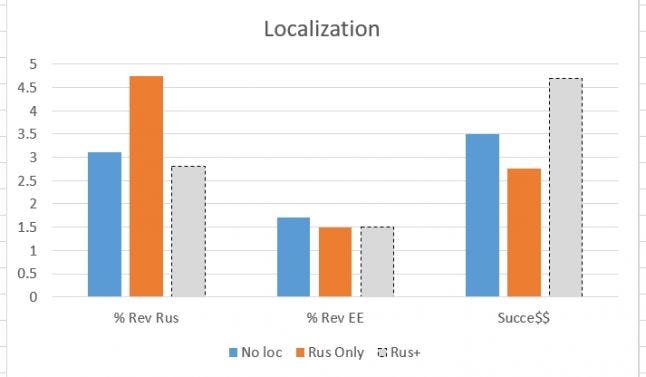

Did You Localize Your Game for the Region?

Only 3 games localized past Russian, presumably because they were already successful and it made sense to invest in the game further.

One game’s Russian translation arrived 2 years later than the others, while one of the “Russian+” games was entirely localized by unpaid volunteers.

What Steam Tags Does Your Game Have?

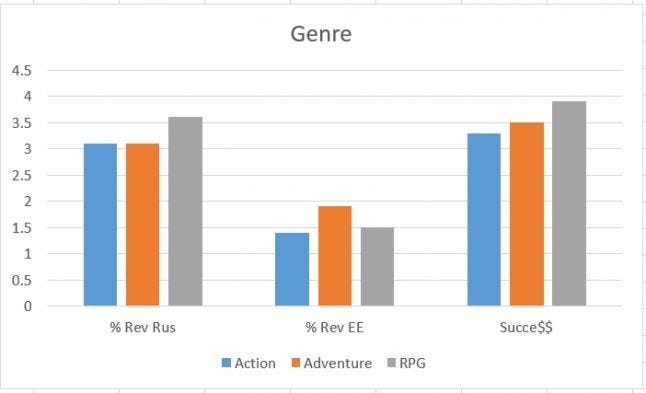

Keep in mind 1 game could have any or all of these tags. In the dataset, there were 10 Action, 6 Adventure, 7 RPG, and then a handful of others (Strategy, Casual, Tower Defense, Roguelike, Roguelite, Platformer, etc). I had some sort of hunch that more ‘hardcore’/challenging/complex game genres would do better in the region, but then again, it’s difficult for Steam tags to encapsulate how hardcore something is, and we only had 1 Casual entry to compare against. Perhaps in retrospect I should have asked participants to rate how ‘hardcore’ they felt their game was.

Someone also noted that their game included a free competitive tactical demo, which had 14% Russian units downloaded and 3% EE units, even without translation. So that seems like an interesting outlier… either in genre, price, or some other element. Speaking of price...

What Did You Charge?

We only had a small number of games submitted with prices that weren't $9.99 or $14.99, but it seemed pretty clear that the lower price games performed slightly better proportionally in Russia and Eastern Europe. I even tried controlling for age (removing games before 2013) to account for potential high discounts, but the graph looked very similar.