[The GameDiscoverCo game discovery newsletter is written by ‘how people find your game’ expert & GameDiscoverCo founder Simon Carless, and is a regular look at how people discover and buy video games in the 2020s.]

Hey folks, and welcome back to the GameDiscoverCo free newsletter, beaming out to almost 8,500 of you fine game discovery-centric folks via email - and also via our regular GameDeveloper.com crossposts. Oh, and an anniversary is happening… now?

It’s been ONE YEAR since we started GameDiscoverCo officially, hurray. Thanks to all you free and paid subscribers - and all consulting clients - for supporting us. Related: here’s a new Heyday ‘creator economy’ interview with me where I talk about what GameDiscoverCo is up to - and learnings so far.

So, onward to the fine free content. And don’t forget, these free newsletters are effectively subsidized by kind folks supporting our Plus tier (info!), which is discounted for the next week. Only $10 a month if you grab a year.

Do you want 30x Week 1 for Year 1 Steam revenue?

So, something we love talking about - although it tends to be relatively rare - is games that ‘take off’ after a slow initial launch. We’ve talked about how roguelite autobattler SNKRX did just that, and now we have another example.

The devs of tactical roguelike autobattler (ah, another autobattler!) The Dungeon Beneath reached out to us after seeing our recent article on Steam long tail revenue. And they are definitely an outlier to our normal view of ‘Year 1 = 2x to 4.5x Week 1 Steam revenue’.

They explained: “Part of the reason we're an outlier is (as you talked about in the article) we had a relatively small first week, with Steam revenue of ~$4.5k. However, since launch [in October 2020] we've grossed ~$112k [USD].”

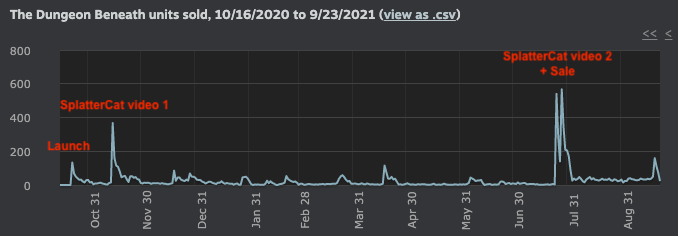

So that’s 25x Week 1 already, and maybe heading towards 30x by the end of the full year. I know for some of you, those total numbers may not be impressive, but they’re decent and accelerating! And you can see here how this happened:

So it looks like the game has had a lot of smaller spikes - generally tied to discounted sales or game patches/updates. And the devs noted what we can view above: “While the numbers are relatively small, they're a great ROI given the low development costs. And yes, the biggest driver of sales for us have been the two SplatterCat videos.”

The first SplatterCat video is here, and we’ll embed the second one below so you can get a good look at it. (It’s got 118,000 views on YouTube and viewer comments like: “I think this us absolutely a winner! Great soundtrack, awesome art direction for the game, and just the right amount of combat/rewards system. I think ill pick this up!”)

We’ve talked about SplatterCat before, since he plays new games all the time - very rare for a YouTuber. In addition, he has 666k loyal YouTube subscribers, is a fan of systemic & replayable games, and has been a positive factor in success stories for games we’ve covered like Nova Drift.

What’s also intriguing is the change in ‘base’ sales after the second SplatterCat video, and then its first-ever 50% off sale three days later on July 29th. The devs noted to us: “Interestingly, after the spike from the second video, our "sales floor" seems to have increased. We went from selling a handful of copies each day (outside of updates & sales) to ~30 copies per day.”

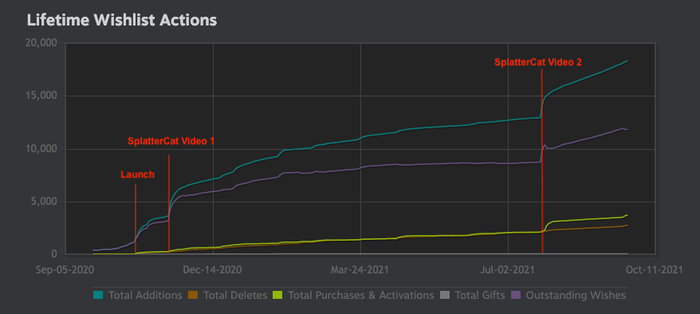

You can really see a change in the wishlist rate in addition to the sales rate, timed to the second SplatterCat video and 50% off sale:

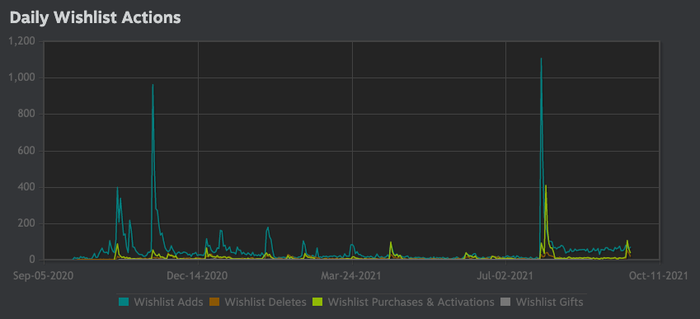

Finally, the devs were kind enough to provide the Steam ‘wishlist actions’ cart for the entire history of The Dungeon Beneath to date. As you might expect, most of the wishlist spikes can be tracked to either patches or discounts:

Actually, this might be a good time to reveal we’ve been talking to SplatterCat for an in-depth interview on streaming and game discovery - it’ll run in the free GameDiscoverCo newsletter next week.

While conducting that, we mentioned The Dungeon Beneath, and he said the game was one he particularly heard about post-video, with viewers lamenting it was both fun and fiendishly playable. So: GaaS-style improvements, a landmark discount, a ‘second bite’ from a popular YouTuber all combined to make a pleasant sales spike and change in base sales. That’s how you do it, folks.

Apple Arcade: let’s talk about the pivot?

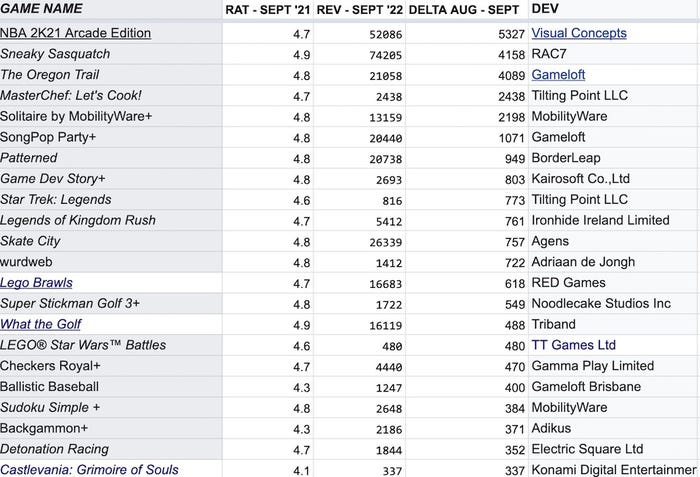

We’ve been monitoring game subscription service Apple Arcade pretty much since its September 2019 launch. And in fact, Plus subscribers can check out the above spreadsheet, updated monthly for every single Apple Arcade game. Just explaining what you’re seeing:

The above view is the top 20+ Apple Arcade games, sorted by ‘U.S. review delta from August to September’. This ranks the games that got the most extra reviews in that one month period. So it provides an interesting gauge of popularity. (One major caveat: some of these titles prompt the player to review, and some don’t.)

We also include their average U.S. App Store review score out of 5. And yes, the games with the most new ratings score better than average. The average ranking across all 210+ Apple Arcade games is 4.14 out of 5, yet basically all of the Top 20 here score 4.6 out of 5 or above. (Quality matters!)

From the titles listed here, approximately one third (7 in total) are from the new ‘Plus’ program Apple implemented after its pivot. This is basically ‘copy across existing premium or F2P iOS games, but with ads or other monetization removed’.These titles have a ‘+’ in the name as a hack, so they be listed uniquely and don’t get confused in Apple search.

So you can see the kind of games now doing well on Apple Arcade: NBA 2K and Sneaky Sasquatch are perma-atop the charts, with strong performances from the reboot of The Oregon Trail, music trivia game SongPop Party, Solitaire, puzzle game Patterned & lots more.

Bonus stats for you: the average ‘monthly delta’ of extra U.S. reviews for each Apple Arcade game from August to September was 164. But the median was just 12 extra reviews. So any game receiving 300+ new reviews is doing pretty well.

Anyhow, it’s very interesting to see where Apple Arcade has ended up after the hundreds of millions of dollars spent on its launch line-up. For me, there’s been these major - and successful - pivots:

Apple Arcade can’t compete with consoles: early on, the service commissioned custom games that were intended to be played console-style with controllers as much with touchscreens. But it’s REALLY rough - gameplay-wise - to do both well. And as we wrote: “We [believe] the iOS store is the vast majority (95% or more) of the reviews and play time on Apple Arcade. (Apple Arcade is also available on tvOS and MacOS, which have 1-2% of the amount of reviews.)” Now the focus is much more on touchscreen and iOS, which makes way more sense and is producing better results.

Critical darlings don’t always make for replayable hits: the early Apple Arcade line-up - and even some mid-lifetime titles - were well crafted indie titles with class. But they were intentionally story-led, linear and not super deep and replayable. I think of titles like Little Orpheus or even The Last Campfire, which were beautiful, but perhaps not a great fit beyond a niche audience. The solution thus far seems to be to get custom versions of already proven, replayable franchises like Oregon Trail, Kingdom Rush or Reigns.

All-original games were not a good Apple Arcade differentiator: although it might have seemed cleaner to just commission all-new games, the hit rate wasn’t that great. And actually, the ‘hook’ of a lot of the initial crop of titles was poor. People would love to play premium, free or F2P iOS apps without ads/IAP - so why not just convert some across or get exclusive versions somehow? This is a majority of the current Apple Arcade output, and there’s fertile ground to grab these ‘+’ titles from.

The Apple One subscription has - and will - change the demographic of subscribers: Early on, Apple was struggling to define its target audience. But with the roll-out of the Apple One subscriptions, and with Apple Arcade bundled in every tier, it’s clear that a lot of casual players will just get Apple Arcade because they wanted Apple Music, TV+ and Cloud, for example. So you can go a lot broader and mass-market with the kind of games you pick, as opposed to trying to attract solely ‘core gamers’ or people who would pay standalone for a video game service.

It’s also been interesting to see Apple ‘rescue’ larger projects that only soft-launched previously, like Lego Star Wars Battles and Castlevania: Grimore Of Souls, by essentially saying ‘you couldn’t monetize well enough on the wider App Store, but we’ll pay to usher you into Apple Arcade’.

Unfortunately, all of this change is definitely meaning that Apple is signing bigger, known IPs and franchises and already successful/shipped iOS games into Apple Arcade. It’s become lower-risk for them - precisely because they have reconfigured to offer money to games/IP which has already had some success.

Of course, Apple Arcade is still a drop in the ocean compared to other App Store profit from their 30% cut of F2P game revenue. As just estimated by the Wall Street Journal: